In this rapidly changing world, protected area managers must act speedily towards generating new and creative ways of doing conservation and sustainable use of financial resources. However, how can protected areas utilize existing financial resources optimally, and where can their management tap into new sources of funding? A webinar hosted by the Caribbean Protected Areas Gateway of the Biodiversity and Protected Areas Management Programme (BIOPAMA) aimed to help protected area practitioners and environmental managers answer these questions.

Under the 1993 Convention on Biological Diversity (CBD), countries pledged to generate and allocate resources towards biodiversity conservation and protected areas (PAs). The CBD often shapes donor agendas and national biodiversity strategies and plans. Despite these pledges and plans, the majority of PAs are still facing enormous challenges, from the insufficiency of vital financial resources to new worldwide threats such as the novel Covid-19 pandemic.

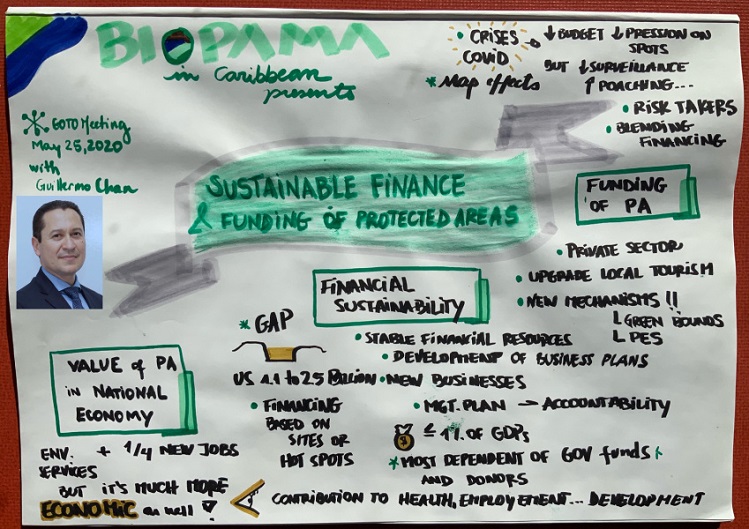

In this context, the Caribbean Protected Areas Gateway of the BIOPAMA Programme hosted on 25 May 2020 an online discussion on sustainable financing and resourcing of protected areas.

The guest speaker, Mr. Guillermo Chan V, a sustainable finance expert, addressed three main topics:

- The value of protected areas,

- The importance of financial sustainability in protected areas.

- Funding protected areas during challenging times.

Watch the online discussion

Presentation takeaways:

• Protected areas (PAs) provide multiple benefits for local people, communities and the environment. In many Caribbean countries, PAs contributes significantly to national economies.

• Many governments have recognized the importance of preserving protected areas, especially as issues such as the Covid-19 pandemic expose the need for safe spaces amongst cities and countries around the globe. However, there is a need for a balance between the primary role of protected areas and the sustainable use of protected areas for tourism and recreational services.

• Now more than ever, as PAs experience the repercussions from the global pandemic, agencies and practitioners need to continuously search for stable financing mechanisms to minimize the impact of visitation declines, reduced revenue from tourism and possible cuts to park operational budgets.

• The impact of protected areas on local society and the economy has variable but growing recognition. Often PAs are considered burdens to the state budget and not as a generator of wealth. PAs are estimated to require USD $1.1-2.5 billion to meet basic needs. In order to gain the necessary capital for Protected Area financing, agencies need to work along with the private and public sectors, local communities, social groups, decision-makers and other key players.

• Tourism business expenditure plays a significant role in sustaining many protected areas. In 2019 the travel and tourism sector created 1 in 4 new jobs globally. It accounted for 10.3% of the global GDP, making the sector larger than agriculture. The economic contribution of wildlife tourism is equally impressive. In 2019, it contributed USD $400 billion and supported 22 million jobs across the world.

• The global pandemic has had immediate and may possibly have long-term effects on protected areas. The coronavirus resulted in the closure of parks and protected areas in many countries, resulting in a cascade of impacts. As nations leave their lockdown phases, challenges such as job loss, changing views on international travel and the reallocation of government budgets to priorities such as health care are forecast to compete with protected areas budgets. Reduced revenue from tourism and cuts in national parks operational budgets are anticipated.

• In 2020 the air travel industry expects losses amounting to USD $250 billion due to the global pandemic. Similar losses are expected in the hotel industry, with 40% of bookings cancelled. Innovative funding mechanisms are needed to support families and communities that rely on tourism and protected area activities.

• Protected areas often compete with other sectors within national development plans, such as health, defence and education. Government budgets remain one of the largest sources of PA financing in most countries; however, these contributions have failed to keep up with the expansion of PAs needs in recent years. Traditionally, funding committed to conservation is less or hardly equal to 1% of GDP. The reality for most protected areas is the dependency on a mix of financial support from the government, international agencies, donors and NGOs working along with the government to support and sustain the Protected Area.

Despite the gains in the management of protected areas achieved in recent years, Chan explained that many management plans from the Caribbean were prepared and published without incorporating vital financial components. The lack of a business-oriented focus by protected area management contributes to unrealistic ways of resolving financial gaps. Conservation Plans often lacked analysis of the actual PA needs. At the country level, there were very few PAs that incorporated the business approach of planning and accountability.

“Managing protected areas goes beyond merely the biological part of the pie. It involves working proactively to improve sources of revenue and financial metrics”. Chan emphasized that conservation plans should be “tied to more realistic budgets and investment portfolios, and not exclusively tied to government funds and donors, to ensure a sustainable source of revenue for protected areas”.

According to the World Economic Forum, “many of the most vulnerable developing countries, including Small Island Developing States (SIDS), may not be able to endure and recover from this [COVID-19] crisis in the absence of adequate development finance support. Robust multilateral cooperation and the strong support of the international community are essential to enable the most vulnerable developing countries, such as SIDS, to respond and recover”.

In his presentation, Guillermo Chan noted that charting the way forward would have to include governments and private sector working together towards “new roadmaps for internal finance during times of crisis. These road maps should encompass the required fiscal and legal reforms that allow rapid responses and promotes incentives for new private ventures. And that is the key” [sic].

“In countries with a lot of potential in the private sector, the government must understand that they need to ease the access of funds. They need to prepare more incentives for the private sector for them to be a key participant in national economy” Chan furthered.

Many companies recognize strategic and systemic risks arising from ecosystem degradation. Chan pointed to different networks of donors interested in making a significant impact in PAs such as private investors, banks and institutional investors. A range of innovative financing mechanisms and initiatives have been developed and implemented by organizations and individuals such as the USD $10 billion Bezos Earth Fund, established to fund activists, scientists, and NGOs in an effort “to preserve and protect the natural world.”

Concern remains that current financial flows are inadequate to sustain let alone to expand PA networks, particularly in under-represented marine environments. There is a real need for new and innovative ways to finance and supplement existing funding for PAs.

Chan concluded his presentation by offering practical ways (with examples from the Costa Rica road map) to increase tourism in protected areas, including:

- Working with local hotels and restaurants to reduce the costs of meals by using only local producers.

- Reducing fuel & electricity costs for tour operators and incentivize domestic travel.

- Tolls and fees should be reduced to 50% at least for a year.

The webinar saw insightful and informative discussions from 86 participants who included representatives from government agencies with responsibility for environmental management, finance and protection, NGOs involved with PA management and national environmental agencies.

Participants showed interest in finding out more about:

- The benefits of investing in Green Bonds.

- How MPAs could offer differentiated rates for local communities.

- Diversifying financing sources and payment for ecosystem services.

Selected participant remarks include:

• “It is very risky to have your sustainable funding program based mainly on tourism. As the COVID-19 pandemic is basically reducing people’s desire to travel, as you’ve explained clearly and the protected areas still have work to do. We are actively looking into alternative ways to sustainably fund our protected areas without or with reduced tourism income.”

– Wijnand.

• “We’re exploring other options, blue carbon, energy, some social and environmental bonds…but in very short term for an MPA manager who is facing how to pay staff at the end of the year, the most tangible one that we are working with today is tourism…Obviously, we have seen the past big crises for tourism…and tourism has always shown very good resiliency to shocks, recovering sometimes in less than 2 or 3 months. That’s the past. Today, with this COVID situation…specialized organizations like the WTTC and others all agree, that this is very different from before. We are facing a major one and this will take much more time to recover, but it will recover. In terms of revenues, in terms of visitors, in 2021 should we should recover quite strongly. Tourism has this resiliency and has this adaptation capacity. Maybe we should switch from mass tourism model to something a little more nature based or more ecotourism, which is very good I think. Even in this middle of a crisis, we have to be aware of the limitation of tourism…that’s very clear…Don’t put all your eggs in the same basket and don’t rely on one source. We have to learn to diversify revenues”

– Nicolas.

Read also:

- BIOPAMA/IUCN publication authored by Conservation Capital: “Closing the gap: Financing and resourcing of protected and conserved areas in Eastern and Southern Africa“.

- https://www.goldmansachs.com/what-we-do/sustainable-finance/

- https://action.biopama.org/

Related News

prev